While death and taxes are unavoidable, there are coping strategies to be learned.

To that end, local non-profit Heavens to Betsy organized a unique combination of presenters to share their knowledge at a workshop last Saturday.

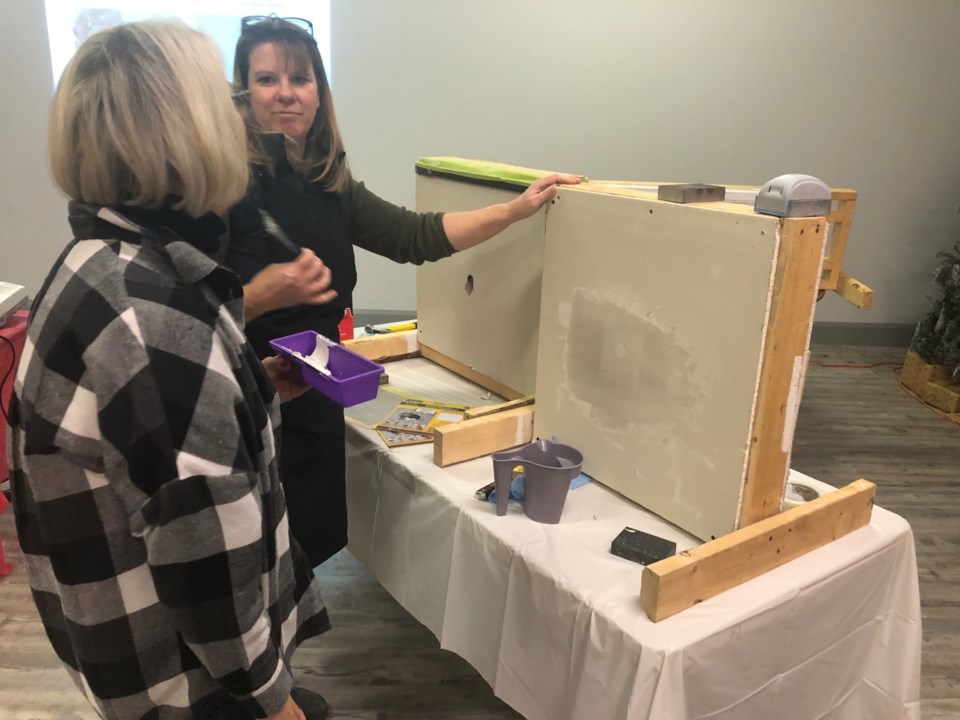

A financial advisor and a handywoman demonstrating how to change a doorknob shared the stage at the Cochrane Lions centre, in the first of a series of talks called the “Building Skills for Independence” project.

The session was aimed at widows and widowers. The financial portion was hosted by Elevate Financial and Rebecca C. Penner, CPA.

Times were tough enough for many people before the recent spikes in inflation and interest rates, but now, especially for widows and widowers who might be looking at some tough financial options, any advice on how to stretch home maintenance dollars is welcome.

The purpose of the session was to empower Cochranites to maintain their own homes, understand financial and tax terms, and have the knowledge to make an informed decision as to whether renting or buying is the best option for their situation.

For people facing financial stress, hiring a professional to do basic home maintenance may not be within their budgets.

Simple projects like drywall repair, caulking, replacing faucets and changing doorknobs were all demonstrated by Tracey Sanden, who learned her skills on the job as a property manager for over 20 years.

Financial advisor Rebecca Penner kicked things off with an overview on financial planning, with an emphasis on some things the recently widowed might want to think about.

People facing those kinds of challenges might, for example, suddenly be wondering if they should take advantage of an increase in real estate prices and consider – possibly for the first time – renting instead of owning.

As always, taxes are a prime consideration.

“A lot of clients are asking questions like, ‘If I sell my house, do I have to pay tax on it,’ or ‘My spouse owned the property, so does it transfer to me,’ so we’re going through all of those little things that people don’t think about,” Penner said.

The Cochrane-based financial advisor said people who’re feeling a bit overwhelmed by the volume of new information, can visit a service like hers for a free initial consultation, to see what specific services they might require.

Death benefits and survivors benefits all have tax implications that can be minimized or maybe sometimes avoided with the right strategies in place.

“There are things to consider before someone passes away, and also after,” she said.

Penner said her mother had benefited from some good advice from the funeral home when her father died, but not everybody has access to the same advice.

“So we’re trying to educate people – particularly those who find themselves newly single, to things they might consider now, and the things they can apply for, and the benefits the government is giving.”

Penner said the recent economic conditions have had an impact on the overall mood of her clientele.

“We’ve definitely noticed that people are very stressed out now, unfortunately,” she said.

She said one way to address that stress is to encourage more future planning.

“Look at your future, create a budget, create a tax plan halfway through the year, so you’re not shocked in April when you get a $5,000 tax bill,” she advised.

Penner provided an overview of some of the questions widows or widowers might want to ask themselves. And she learned how to change a faucet.

It was the first in a series of five workshops Heavens to Betsy has planned in 2024.

The next session in the “Building Skills for Independence” project is scheduled for March 9, and will be aimed at newcomers to Cochrane. For more information, go to the Heavens to Betsy website: h2betsy.ca.

Heavens to Betsy is a registered charity. The goal is to provide educational workshops for communities in need. They work with communities including but not limited to: Indigenous communities, kids aging out of foster care, veterans, newcomers and refugees, and victims of abuse.

Jolene Airth and Tracey Sanden co-founded the charity in an effort to provide skill building opportunities for communities that are underserved, underfunded or underrepresented.