St. Albert’s MLA says she has serious doubts the provincial government will bring in its proposed tax break next budget, despite a promise from Alberta’s finance minister.

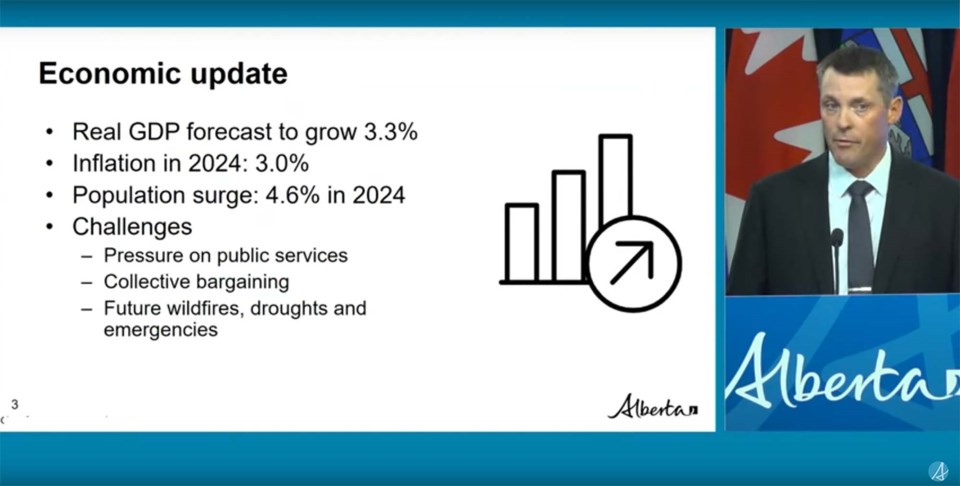

Alberta Finance Minister Nate Horner presented the 2024-25 first quarter fiscal update and economic statement on Aug. 29.

The update shows the province was poised to post a $2.9 billion surplus by the end of the fiscal year, which is $2.6 billion more than predicted by the budget. Horner said this was due mostly to higher than expected oil prices and the start-up of the expanded Trans-Mountain pipeline, both of which have let the province sell more oil at a better price.

Horner noted this is an “accounting surplus” that only exists on paper — the province doesn’t have any actual extra cash to spend, as all of that $2.9 billion is tied up in places such as tuition payments used to fund university operations and the Heritage Trust Fund. The forecast projects the province will actually have to borrow another $600 billion to balance the books.

“That means we must be even more measured and responsible in making budgetary decisions,” Horner said.

“We must manage debt and save for a better tomorrow.”

Price pressures

Government revenues are projected to be $2.7 billion more than budgeted, about $2.5 billion of which from non-renewable resource revenue (mostly oil), the update showed. Expenses are up about $0.1 billion from budget due to a $125 million bump in education spending to account for increased enrolment and $573 million for disaster response, much of which had to deal with wildfires and the evacuation of Jasper. The province has $1.4 billion left in its $2 billion contingency fund as a result.

“There are a lot of pressures we see,” Horner said of the contingency fund, and he expects the province will have to tap into it to address health and family and community support services issues next quarter.

Alberta added about 200,000 more residents in the last quarter, the update found — an increase of 4.4 per cent, which was the highest annual growth rate for that quarter since 1981 and the fastest of all Canadian provinces. This rapid growth contributed to a roughly 50 per cent jump in housing starts in the first seven months of this year compared to the same period the year before, but outstripped job and housing availability. Unemployment is forecast to average seven per cent this year, up 0.5 per cent from budget. Rent and housing costs continued to push inflation up, while retail sales were down 1.1 per cent as consumers tightened their belts.

The United Conservative Party promised during the last election campaign to create a new income tax bracket that would give some families a tax cut. Last February’s budget showed the cut would be delayed until 2026 and not fully implemented until 2027.

Horner said he hoped to bring the new tax bracket forward in next year’s budget.

Renaud skeptical

St. Albert NDP MLA Marie Renaud said the UCP’s tax cut was the first promise that went out the window when they took office after the last election, adding that the province seemed to have no problem with telling Albertans what they wanted to hear.

“I’m skeptical of this government, as are most Albertans.”

Renaud criticized the province for boasting about a surplus while underfunding health and education, noting Alberta has the lowest level of per-student funding in Canada. She said she regularly hears from St. Albert residents who are working multiple jobs to make ends meet, and who had to leave the city because they couldn’t afford rent.

“We need to see real commitment and investment in affordable housing,” Renaud said.

The Gazette has asked Morinville-St. Albert MLA Dale Nally for comment on the fiscal update and will update this piece should he reply.